Ethereum Price Prediction: Navigating the Path to $5,000 Amid Technical Consolidation and Fundamental Catalysts

#ETH

- Technical Consolidation: ETH trading near 20-day MA with Bollinger Band compression suggests impending volatility breakout

- Upgrade Catalyst: Fusaka upgrade in December could drive positive momentum and network improvement expectations

- Holder Dynamics: Mixed signals from long-term holder exits versus accumulation waves create short-term uncertainty

ETH Price Prediction

Technical Analysis: ETH Shows Consolidation Pattern Near Key Moving Average

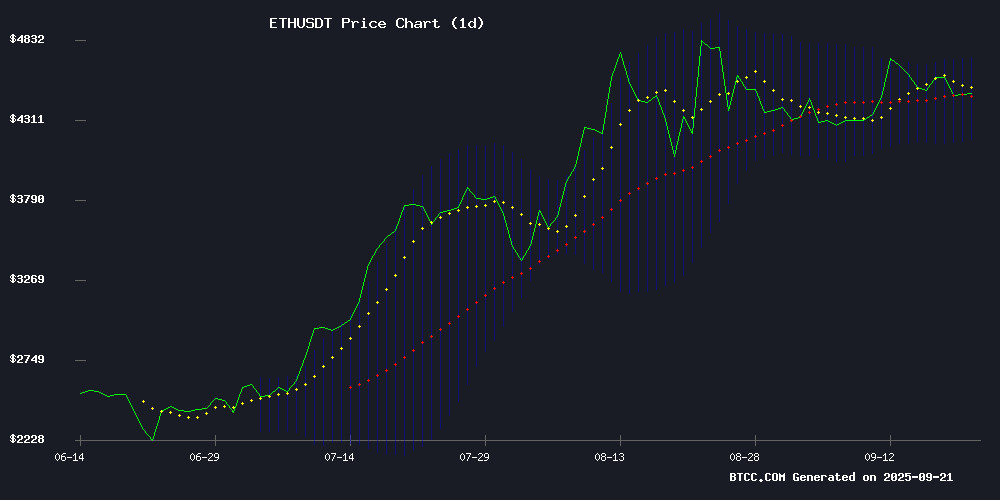

ETH is currently trading at $4,473.16, slightly above its 20-day moving average of $4,449.72, indicating potential support consolidation. The MACD reading of -86.90 suggests ongoing bearish momentum, though the narrowing gap between MACD and signal line (-21.41) points to weakening downward pressure. Bollinger Bands show price action NEAR the middle band with upper resistance at $4,714.01 and lower support at $4,185.43, creating a defined trading range.

According to BTCC financial analyst Ava, 'The current technical setup suggests ETH is building a base around the $4,400 level. A sustained break above the 20-day MA could trigger momentum toward the upper Bollinger Band, while failure to hold this support might test the $4,185 lower band.'

Market Sentiment: Mixed Signals Amid Upgrade Expectations and Holder Behavior

Ethereum faces a complex sentiment landscape with the upcoming Fusaka upgrade targeted for December creating positive anticipation, while long-term holder exits and a significant validator exit queue raise concerns about potential selling pressure. The market is witnessing both accumulation waves not seen since 2018 and warnings of a possible $12 billion sell-off.

BTCC financial analyst Ava notes, 'The news FLOW reflects typical market dynamics before major network upgrades. While technical developments like Fusaka are fundamentally bullish, the market must navigate short-term headwinds from holder rotation. The $4,200 support level remains crucial for maintaining bullish structure.'

Factors Influencing ETH's Price

Ethereum Faces Crucial Test as Analysts Watch Key Support Levels Around $4200

Ethereum (ETH) trades at $4500, with market experts scrutinizing its ability to maintain critical support levels. A breach below $4200-$4300 could trigger a sharp correction, while a hold may reinforce bullish momentum. Analyst Michael van de Poppe highlights $3600 as a prime accumulation zone for long-term investors.

The altcoin leader's price action is seen as a bellwether for broader crypto markets. Van de Poppe's chart analysis suggests $3500-$3800 would present strategic entry points should current supports fail. Market participants await either confirmation of strength or preparation for deeper retracements.

Ethereum Developers Target December Launch for Fusaka Upgrade Amid Price Dip

Ethereum's Core developers have tentatively scheduled December 3 for the mainnet rollout of the Fusaka upgrade, a significant protocol enhancement featuring 12 EIPs. The upgrade aims to optimize data verification, increase gas limits, and expand blobspace capacity—critical improvements for scaling the network.

ETH prices fell 3% to $4,460 following the announcement, though technical analysts note the formation of a potential cup-and-handle pattern if support at the 50-day SMA holds. Testnet deployments will precede the mainnet launch, with Holesky, Sepolia, and Hoodi upgrades scheduled throughout October.

The developer community anticipates further blob capacity expansions post-Fusaka, signaling Ethereum's continued evolution toward greater efficiency and scalability. Market watchers view such upgrades as long-term bullish catalysts, despite short-term volatility.

AI-Generated Ethereum Trading Strategy Emerges Ahead of Fusaka Upgrade

Ethereum's Fusaka upgrade, slated to enhance scalability and reduce transaction costs, has catalyzed algorithmic trading strategies. The network's September 2025 price range of $4,400–$4,600 reflects cautious Optimism as developers finalize testnet schedules during the ACDC #165 call.

Key innovations include partial data blob verification for validators—a hardware efficiency breakthrough—and expanded data capacity for Layer-2 solutions. These advancements accelerate Ethereum's 'Surge' roadmap, positioning ETH as a focal point for institutional and retail investors alike.

'The upgrade transforms capital allocation calculus,' notes Christine D. Kim's tweet analyzing the developer call. Market makers anticipate volatility compression as Fusaka's testnet phase commences, creating strategic entry points for disciplined investors.

MetaMask’s Long-Rumored Token May Arrive ‘Sooner Than Expected’, CEO Says

Consensys CEO Joe Lubin has confirmed that MetaMask's native token, widely speculated to be named MASK, is in development and could launch sooner than anticipated. The token is expected to play a pivotal role in decentralizing aspects of the popular ethereum wallet.

MetaMask has already taken steps toward broader functionality with the recent introduction of MetaMask USD (mUSD), a stablecoin now operational on Ethereum and the Linea Layer-2 network. The stablecoin has quickly gained traction, boasting a market cap of $53 million.

Lubin framed the upcoming token as part of a broader decentralization strategy encompassing MetaMask, Linea, and other Consensys projects. While specifics on governance and rewards remain undisclosed, the token is anticipated to empower users with greater influence over platform decisions and incentivize wallet activity.

MetaMask co-founder Dan Finlay previously hinted that any token launch WOULD be prominently featured within the wallet interface to mitigate confusion and curb impersonation scams.

Ethereum's $5,000 Dream Faces Headwinds as Long-Term Holders Exit

Ethereum's path to $5,000 has hit a snag as long-term holders cash out profits and futures traders maintain bearish positions. Glassnode data reveals ETH's Liveliness metric reaching a year-to-date high of 0.704, signaling increased selling pressure from investors who held through the late-August rally.

The altcoin's month-long consolidation has created a profit-taking window for these holders, with dormant coins now moving back into circulation. This distribution phase contrasts sharply with accumulation periods when liveliness metrics decline.

Futures markets echo this caution, with persistent bearish positioning adding another LAYER of resistance to ETH's upside potential. The combined effect threatens to delay Ethereum's next major breakout despite its strong fundamentals.

Ethereum Sees Largest Accumulation Wave Since 2018 Amid Price Dip

Ethereum's market dynamics are defying its recent price slump. While ETH dipped 1.5% to hover NEAR $4,520, blockchain data reveals institutional players are accumulating the asset at unprecedented rates. Accumulating addresses now hold 28 million ETH - more than double their June holdings - marking the steepest accumulation curve since 2018.

This buying spree coincides with Ethereum's ongoing infrastructure upgrades and growing institutional adoption. The supply shock from such aggressive accumulation could create explosive upside potential when macroeconomic conditions improve. "We're seeing capital deployment reminiscent of early bull market cycles," noted TK Research in a recent market update.

Ethereum Price Squeezes Tight – Watch Out for Sudden Breakout Anytime

Ethereum's price has initiated a fresh upward trajectory, surpassing the $4,550 mark and currently consolidating above $4,600. The 100-hourly Simple Moving Average underscores this bullish momentum, with a contracting triangle pattern forming near $4,620 on the ETH/USD hourly chart. A decisive break above $4,640 could propel ETH toward higher resistance levels at $4,685 and $4,765.

The recovery follows a solid base established above $4,420, mirroring Bitcoin's recent performance. Bulls have successfully pushed the price beyond the 50% Fibonacci retracement level of the prior downturn, though resistance persists near the 61.8% level. Market participants are eyeing a potential surge toward $4,840 if Ethereum clears these critical thresholds.

Ethereum Exit Queue Crosses 2.6 Million ETH With 44-Day Wait Time, Raising Concerns of a $12 Billion Sell-Off

Ethereum faces an unprecedented validator exodus as over 2.6 million ETH, valued at $12 billion, enters the withdrawal queue. Data from ValidatorQueue.com reveals a 44-day backlog—the largest since Ethereum's shift to proof-of-stake in 2022. The parabolic surge in exits since mid-August signals growing institutional unease.

Market analysts warn of potential selling pressure, with staking providers likely driving the mass exits. The queue's scale dwarfs previous withdrawal events, injecting volatility risk into ETH's price trajectory. "Ethereum Staking Exit Queue parabolic," observed analyst MartyParty, capturing the accelerating trend.

Grvt Raises $19M to Pioneer Privacy-First Onchain Finance and Unlock Trillion-Dollar Markets

Grvt, a decentralized exchange leveraging zero-knowledge technology, has secured $19 million in Series A funding. The platform aims to address critical challenges in onchain finance, including privacy vulnerabilities, security, and scalability. As Ethereum's onchain volume hits $320 billion, the DeFi sector is projected to grow from $32.36 billion in 2025 to $1.5 trillion by 2034.

Despite this growth, decentralized platforms face significant hurdles. Whale hunting, MEV attacks, and smart contract exploits continue to plague the ecosystem. Grvt's privacy-first approach seeks to mitigate these risks, positioning itself as a blueprint for the future of finance.

Ethereum Validator Queue Debate Intensifies as ETH Tests $4,600 Resistance

Ethereum co-founder Vitalik Buterin has publicly defended the network's validator queue mechanism amid growing criticism over escalating exit delays. The protocol currently requires a 43-day waiting period for unstaking, with 2.48 million ETH queued for withdrawal.

Buterin framed the design as essential for network integrity, comparing validator commitments to military discipline. "An army cannot hold together if any percent of it can suddenly leave at any time," he stated on X, acknowledging room for optimization while emphasizing trust preservation for infrequent nodes.

The debate emerges as ETH price demonstrates resilience, rebounding from the 20-day SMA to challenge the $4,600 resistance level. Thursday's trading saw the cryptocurrency hovering near $4,590, reflecting ongoing market confidence despite validator liquidity concerns.

Ethereum Eyes $10K as MAGACOIN FINANCE Presale Tops $13.5M

Ethereum's bullish momentum continues to captivate the market, with analysts projecting a potential surge to $10,000. Strong institutional demand, evidenced by record inflows into spot Ethereum ETFs, has tightened supply and helped ETH reclaim the $4,500 support level. August alone saw over $2.8 billion FLOW into these investment vehicles, signaling long-term confidence in the asset.

Meanwhile, MAGACOIN FINANCE, an Ethereum-based project, has garnered significant attention with its presale surpassing $13.5 million. Market observers note the token's community-driven model and scarcity mechanics could deliver 700x returns by 2025. The project's rapid funding pace mirrors Ethereum's own trajectory in previous cycles, when skepticism at $1,400 preceded its 2021 rally to $4,900.

Technical analysts point to Ethereum's positioning outside bubble territory on the Rainbow Chart, with the $9,000-$10,000 range emerging as the next likely inflection point. This outlook is further supported by growing DeFi adoption and consistent whale accumulation patterns.

How High Will ETH Price Go?

Based on current technical indicators and market developments, ETH appears to be consolidating within a $4,185-$4,714 range. The upcoming Fusaka upgrade in December and continued institutional interest provide fundamental support for higher prices, while technical resistance near $4,700 needs to be overcome for a push toward $5,000.

| Price Level | Significance | Probability |

|---|---|---|

| $4,185 | Strong Support (Lower Bollinger Band) | High |

| $4,450 | 20-Day Moving Average | Medium |

| $4,714 | Upper Resistance (Bollinger Band) | Medium |

| $5,000 | Psychological Resistance | Low-Medium |

BTCC financial analyst Ava suggests, 'A successful break above $4,700 could open the path to $5,000, but this requires resolving the current MACD bearish divergence and sustaining above the 20-day MA.'